Travel With The Right Cover For Senior Citizens

To compensate for the time spent in isolation, travellers are returning to their favourite locations as soon as the skies start clearing following the pandemic.

While the travel industry quickly recovered to its pre-pandemic levels, travellers now know about safety precautions beyond masks and hand sanitisers. More people now consider travel insurance a crucial component of their trip to ensure comprehensive protection if they run into an unexpected event while travelling. This includes older people, who had to exercise extra caution, particularly during the pandemic.

You can use a travel insurance premium calculator to get a more detailed estimate of the costs involved.

Before selecting a senior travel itinerary, consider the following:

- Pre-Existing Diseases

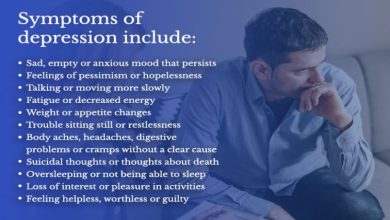

Regular travel insurance may protect travellers from hospital costs, but excluding coverage for PEDs and pre-existing conditions is expected. Therefore, it is always advisable for senior citizens to choose a plan that offers a range in case of life-threatening infections caused by PEDs.

- Longer Duration Stay

Young people frequently relocate abroad in search of better opportunities. Most frequently find stability there and even make long-term residences outside of India. In these situations, their parents may need to visit them and often stay longer.

- Plans Without Sublimits

Plans for travel insurance include sub-limits, just like health insurance does. It’s also advised to avoid having sub-limits in your travel plans, just like with health insurance. These limitations may reduce coverage, particularly for senior citizens.

Sub-limits refer to a cap on the benefits or sum assured. It might imply that certain medical expenses are excluded or that benefits are reduced. It is preferable to choose plans without sub-limits to prevent this from happening. In this case, the policyholder can waive any sub-limit and protect themselves from any undesirable situation for a small additional premium.

- Comprehensive Cover

A requirement for senior citizen travel is comprehensive travel insurance coverage. It entails sufficient insurance coverage and an extensive network of hospitals to keep you safe. Your risk profile may affect the premium you pay. For instance, the premium will be higher when visiting the USA, Canada, or Schengen nations because of the higher cost of healthcare in these nations than in India or other Asian countries. However, some plans don’t call for annual physicals, cover PEDs, and offer cashless hospitalisation for older people.

- Travel Advantages

Travel insurance for senior citizens should provide adequate coverage on all fronts. Therefore, carefully reviewing the plan’s inclusions and exclusions is crucial. The insurance should cover everything from pre-existing conditions, ICU costs, trip delays and cancellations, and lost passports.

- Transparency

Uninsured international travellers run a significant risk to their health and finances. Additionally, just as important as purchasing the policy is fully disclosing all pertinent information to your insurer. Regardless of your health status, be honest with your insurer to prevent a later claim rejection.

To make an informed choice, compare the features and costs of various policies online.

Standard T&C Apply

Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms, and conditions, please read the sales brochure/policy wording carefully before concluding a sale.