Strategies To Pay Off Your School Debt

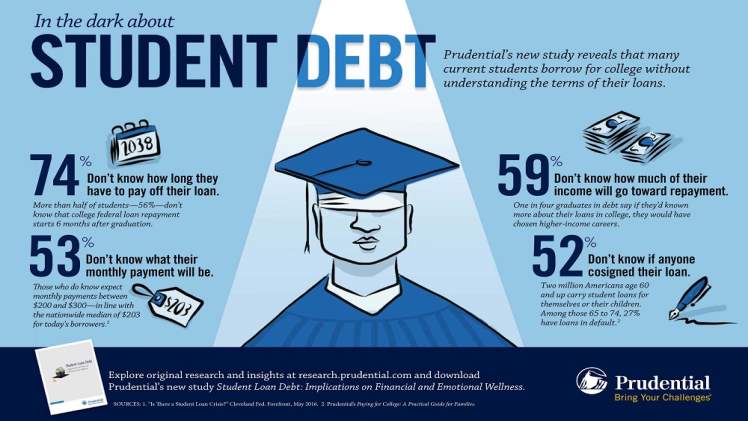

You’ve just graduated from college and have a mountain of student debt. But what do you do? You can’t walk away from your loans; that won’t help anyone. You need to devise a plan to pay off your student debt so that it doesn’t follow you around for the rest of your life. In this article, you’ll discuss some strategies for paying off student loans quickly so that you can move on with your life!

Refinance Your Private Student Loan

Refinancing your private student loan can be an effective way to save money on interest. You can refinance private student loans, and you might get a lower interest rate by doing so. However, there are some important things to keep in mind before you decide to refinance your student loans.

First, if you have a variable rate loan, refinancing may not make sense for you because it could increase the amount of interest paid over time. If you have a fixed rate loan instead, like most home purchase mortgages or car loans, refinancing is very likely worth considering.

Lower Your Interest Rate

You can lower your interest rate if you have federal loans by refinancing them with a private lender. This isn’t free you’ll likely have to pay some fees—but it can help cut down on the money you’re paying toward your loan’s principal. For example, if you have unsubsidized Stafford loans, where your interest is calculated monthly but only paid after graduation, refinancing may be worth it for the better rate alone.

As per advisors like SoFi, “If you still owe federal student loan debt or have private student loan debt, refi today to save money before rates rise even higher.”

Consolidate Your Federal Loans

Consolidating your federal loans with a Direct Consolidation Loan may lower your interest rate and monthly payments. However, there are some downsides to this option. The amount you pay in total interest will increase because the loan term is extended by 10-15 years.

Also, if you currently have unsubsidized Stafford loans, they will convert to subsidized Direct Consolidation Loans and therefore lose their grace period of six months before repayment begins.

Additionally, consolidating private student loans can decrease monthly payments but increase the total amount paid over time due to increased interest rates on these types of debt.

Choose a Repayment Plan Based on Your Income

You can also choose to repay your loan on an income-driven repayment plan. These plans make it easier for you to pay off your student loans by capping the amount of money you owe each month at a percentage of your income. And unlike standard repayment plans, which have fixed payment amounts, income-based plans will adjust the monthly payments based on changes in your salary.

If you’re struggling with how much you owe or are worried about making monthly payments, applying for an income-driven repayment plan may be beneficial. You can apply directly through federal student loan servicers (the agencies that actually manage federal student loans). You can also talk with them about whether any other options might work better for you based on your situation and circumstances at that time.

These strategies should help you pay off your school debt quickly and efficiently. Remember that it’s crucial to stay on top of your payments as soon as possible so that you don’t end up paying more than necessary over time. If you’re struggling with how much money you owe after graduating college, then consider looking into some of these options.