Everything You Need To Know About Refinancing An Auto Loan With Bad Credit

So you need a new car and your credit is not what it used to be. If you’re like most people, refinance auto loan with bad credit may seem impossible. In fact, it’s far from that! With a little leg work and patience, you can get the auto loan refinance you need so that you can buy the car of your dreams.

How can you find the best refinance interest rate?

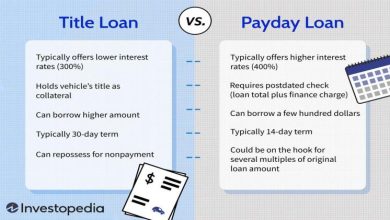

If you’re looking to refinance your auto loan, one of the most important things to consider is what kind of interest rate you’ll get. Interest rates vary from lender to lender and can depend on many factors: your credit score, the length of your loan, or even how much money is needed for a down payment. To get an idea of where you stand and what kind of interest rate you should expect when refinancing, check with multiple lenders first.

Some lenders may offer better rates than others. However, it’s important to keep in mind that just because one lender offers a lower APR doesn’t mean they’re automatically going to be the best option for you—there are other factors like length and size that need consideration as well.

What is the difference between a hard and soft credit inquiry?

The first thing to know is that there are two kinds of credit inquiries: hard and soft. A “hard” credit inquiry is a traditional credit check, like when you apply for something like a mortgage or auto loan. It can lower your credit score slightly if you have many of them within the last two years. Hard inquiries do not affect your score as much as having late payments or maxing out your lines of credit does, but they will still cause some dings in your overall picture.

You Get all Info About Coding

What happens if you pay off your auto loan early?

If you pay off your auto loan early, you’ll likely be charged a penalty. It’s not uncommon for lenders to charge a fee based on how much money was still left on the loan when you paid it off. If this is the case with your lender and they do charge such a fee, it may affect your credit score.

As you’ll find out later in this guide, having an active auto loan can help improve your credit score because it shows that you’re responsible with money management and have steady income (since your car payments are typically made through automatic debits).

Why does refinancing your car loan matter?

Refinancing your auto loan can help you save money, get a lower interest rate, reduce your monthly payment and/or extend the length of your loan.

The main reason to refinance is to save money on interest charges. When you refinance an auto loan with bad credit, your current lender will generally sell the debt to another company that is willing to take on the risk of providing financing for people with low credit scores. The new lender may offer a better deal than what you currently have in order to win over customers who are looking for lower rates or longer terms.

By now you should be well informed on the ins and outs of refinancing your car loan, but if you still have more questions research more for it online. As Lantern by SoFi states, “Just remember it’s important to weigh the pros and cons of refinancing your car before you make the leap and sign up for a specific loan.”